India’s Electric Car Market in 2024: Slow Growth, Limited Choices, and Emerging Competition

Despite the global push towards electrification, India’s electric car segment struggled to gain momentum in 2024, accounting for only ~2% of total car sales. This slow adoption reflects key challenges, including limited model availability, inadequate charging infrastructure, and consumer hesitation in transitioning from traditional ICE (internal combustion engine) vehicles.

Limited Choices, Dominated by Few Players

The Indian EV market remains highly concentrated, with only a handful of models dominating sales. Tata Motors has been the clear leader, with its Nexon, Tiago, and Punch EVs driving volume. However, MG Motor is quickly emerging as a strong competitor, particularly with its Windsor EV, which has seen strong acceptance due to its practical pricing and features.

One of the biggest hurdles to EV adoption in India is the lack of variety in the mid-range segment (₹10 lakh – ₹18 lakh). This price band is where the mass-market operates, and currently, only a few models (such as the Tata Nexon EV and MG Windsor) cater to this demand.

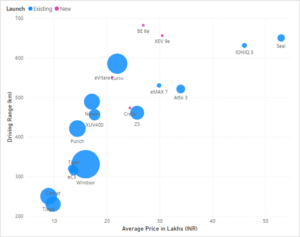

Chart: Vehicle price vs. Driving range of electric cars currenty in mass market segment in India

Price and Range taken from top trim of the model. Bubble size is average monthly sales for Oct-Dec 2024. Price for new launches assumed based on news reports and social media discussions.

New Launches: Expanding the Market but at a Higher Price

As the market matures, new models are entering, but most are positioned at higher price points, targeting premium consumers rather than mass buyers.

- Tata Curvv (₹21.99 lakh, 585 km range) and MG Windsor (₹16 lakh, 331 km range) have seen positive responses, despite their different price points.

- Upcoming launches from Suzuki (eVitara), Hyundai (Creta EV), and Mahindra (BE 6e, XEV 9e) are expected to offer higher ranges (550 km+), but their success depends on consumer interest, given their pricing above ₹20 lakh.

This shift towards higher-priced EVs with extended ranges raises a critical question: Will Indian consumers prioritize range over affordability? The early response to Tata Curvv and MG Windsor suggests there is demand for well-positioned EVs with the right balance of price, range, and features.

Outlook: Will Consumers Accept Premium EVs?

The success of upcoming models from Hyundai, Mahindra, and Suzuki will depend on whether Indian consumers are willing to pay a premium for longer range and better technology. While MG Windsor and Tata Curvv have shown initial success, it remains to be seen whether buyers will accept higher-priced EVs.

The Indian EV market is at a crossroads—whether it accelerates or remains niche depends on how well manufacturers align their offerings with real consumer needs.

One Response

First Comment